Looking for Algarve property?

Maybe an investment property in Portugal, an apartment in Lagos or Luz or villas in Portugal, well Buying Property in Portugal Agents has a portfolio of property for sale in Portugal that will suit you.

Select your property

Let us try to help you find what you're looking for.

Our experienced Portugal property professionals appreciate the difference between buying an apartment in a condominium or a villa with swimming pool.

We have a range of properties for sale in the Algarve and can give impartial advice on the search and eventual purchase of your holiday home in Portugal.

Complete furnishing solutions

When it comes to furnishing your dream home in the sun, our preferred partner Abode Furniture takes over!

Whether you're a property investor or a second homeowner, we have the best solutions this allows you to sit back and relax.

Settling into your new life in Portugal

Buying a property in Portugal is exciting, whether you plan to live there permanently or visit often for holidays.

We can help you every step of the way, so you can settle in properly and make the most of living in Portugal.

Virtual Property Tours with Ideal Homes!

Viewing properties virtually with an expert consultant that can answer all of your questions regarding purchasing in the country you are interested in, along with queries on the properties you are viewing.

What better way to view properties for sale across the Algarve than from the comfort of your own home?

Living Overseas made easy

Our associated furniture company provides furniture packages and the perfect furniture solution for your home abroad.

We provide a range of high quality "ready-made" furniture packages which can be adjusted to your own requirements, the furniture packages are completely flexible so feel free to change items, increase or decrease the inventory, pick colours or fabrics, alternatively leave it up to us!

Buyer's Guide

An easy step by step procedure to follow once you have decided to purchase, and we have negociated the best possible price and conditions on your behalf.

- ✔ Understand Brexit

- ✔ Find your property

- ✔ Ask the right questions

- ✔ Avoid losing money

- ✔ Avoid the legal pitfalls

- ✔ Move in successfully

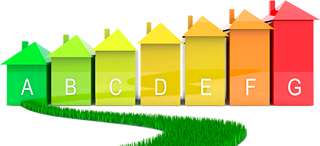

Energy Certificates in Portugal

It's now mandatory to obtain an Energy Efficiency Certificate prior to selling your property.

What is needed for the survey to be done?

Documents required:

- Land Registry

- Building Booklet

- Housing Permit

- Architect / Project Plans

- Datasheet

What does the energy certificate entail?

The aim of the energy certificate is to measure and grade a property's energy efficiency.

A qualified architect or engineer will visit the property and assess it taking into account its construction materials, insulation, equipment (such as heating, air conditioning etc), location and sun exposure.

Interior Design Service

Build your dream and create your perfect living space. Let us help you with your bespoke plans.

All of Abode furniture interior projects start with a personal consultation which gives us the opportunity to learn about our client’s individual style and expectations.

By showing examples of our work and walking around Abode Furniture showroom we will identify inspirational pieces which allow us to better understand the look our clients want to achieve.